Table Of Content

The rate and monthly payments displayed in this section are for informational purposes only. Payment information does not include applicable taxes and insurance. Zillow Group Marketplace, Inc. does not make loans and this is not a commitment to lend. A mortgage rate lock means that for a period of time, you'll get that interest rate even if market rates change before your loan closes. Most lenders offer several mortgage rates, depending on what your score is. Every lender decides what credit score will qualify for their lowest rate, but it's typically around 740.

HomeServices Becomes Final Brokerage To Settle Real Estate Agent Fee Lawsuit

These autofill elements make the home loan calculator easy to use and can be updated at any point. Today’s average rate on a 30-year mortgage (fixed-rate) rose to 7.65% from 7.57% yesterday. The lowest-risk rate locks are fee free and have a float-down feature.

How to access your home’s equity

To use the calculator, enter the beginning balance of your loan and your interest rate. Next, add the minimum and the maximum that you can pay each month, then click calculate. The results will let you see the total interest and the monthly average for the minimum and maximum payment plans. She adds that if the inflation rate holds at 2%, then we should see mortgage rates remain at lower levels for the balance of the next five years.

MORTGAGE LENDERS

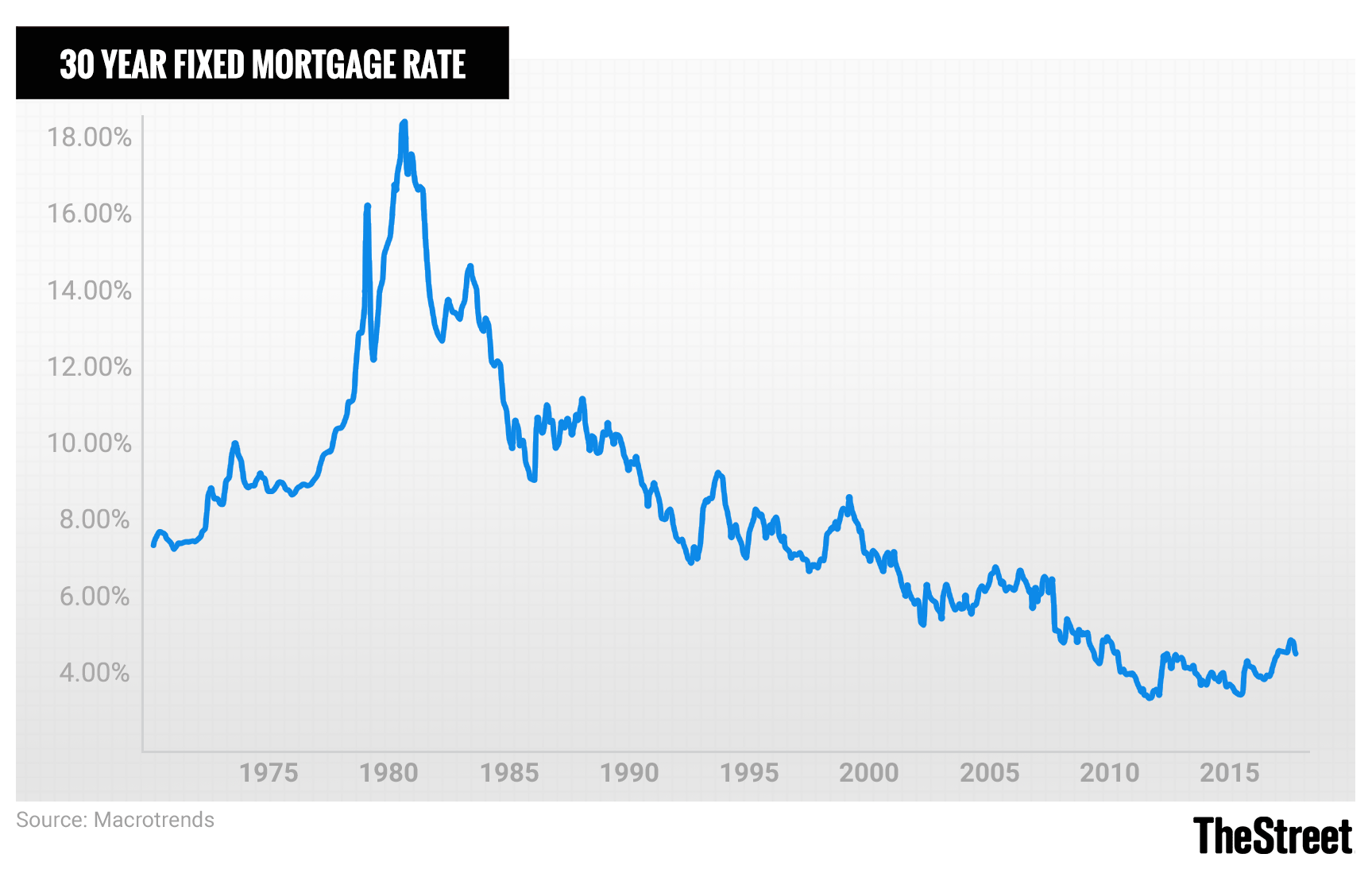

The Fed’s economic projections indicate the federal funds rate will remain higher through 2025 and in the longer run than previously expected. If those projections remain and the Fed begins to lower its key rate, mortgage rates will presumably follow suit. Demand for mortgages can also affect rates, pushing them higher as available capital for lending tightens. Meanwhile, many borrowers are sitting on the historically low mortgage rates they nabbed during the pandemic.

Mortgage Rate Lock Guide – Forbes Advisor - Forbes

Mortgage Rate Lock Guide – Forbes Advisor.

Posted: Fri, 26 Apr 2024 12:32:00 GMT [source]

Katherine Watt is a CNET Money writer focusing on mortgages, home equity and banking. Based in New York, Katherine graduated summa cum laude from Colgate University with a bachelor's degree in English literature. The closer your details are to assumptions – you have the same credit score, the same DTI, the same loan amount – the more likely it is you’ll get a similar rate.

What Is A Home Equity Loan? - Bankrate.com

What Is A Home Equity Loan?.

Posted: Fri, 26 Apr 2024 21:11:15 GMT [source]

At the January Federal Reserve meeting, it was hinted that there could be three rate cuts, rather than hikes, anticipated for 2024. Most economists widely expect a decline from the peak rates seen last year—but only a modest one. To cut costs, that could mean some buyers would need to move further away from higher-priced cities into more affordable metros.

Thinking about taking out a mortgage loan? Here are the current mortgage rates and the top factors that influence them.

Fixed mortgage rates move with the 10-year Treasury yield, while adjustable-rate loans more closely follow the Fed. Our advertisers do not compensate us for favorable reviews or recommendations. Our site has comprehensive free listings and information for a variety of financial services from mortgages to banking to insurance, but we don’t include every product in the marketplace. In addition, though we strive to make our listings as current as possible, check with the individual providers for the latest information. For borrowers with a credit score of 720 or higher who prequalified on Credible.com’s personal loan marketplace, the average interest rate on a three-year personal loan is 12.09% as of October 2022.

How to Get Preapproved for a Mortgage, and Why It’s So Important

Average 30-year fixed mortgage rates nearly reached 8% in the second half of 2023, but finally fell below 7% in mid-December. This year mortgage rates remained consistently below 7% until late April, when they crept up to 7.17%. Adjust the graph below to see 30-year mortgage rate trends tailored to your loan program, credit score, down payment and location. Following the COVID-19 pandemic, the Fed implemented an expansionary monetary policy to help the economy, resulting in great rates for homeowners. If a homeowner has not taken advantage of the great rates in the last two years, they should refinance as soon as possible to try to lock in a lower rate.

Here’s a look at where some major housing authorities expect average mortgage rates to land. The current average mortgage rate on a 30-year fixed mortgage is 7.65% with an APR of 7.67%, according to Curinos. The 15-year fixed mortgage has an average rate of 6.86% with an APR of 6.89%. A 30-year jumbo mortgage at today’s fixed interest rate of 7.61% will cost you $707 per month in principal and interest per $100,000. On a $750,000 jumbo mortgage, the monthly principal and interest payment would be approximately $5,302. A mortgage rate shows you the amount of money you’ll have to pay as a fee for borrowing funds to purchase a home, and is typically expressed as a percentage of the total amount you’ve borrowed.

You can check rates online or call lenders to get their current average rates. You’ll also want to compare lender fees, as some lenders charge more than others to process your loan. Finally, your individual credit profile also affects the mortgage rate you qualify for. While the policymaker doesn't directly set mortgage rates, its decisions do influence their direction.

That tradeoff needs to take into account how long you see yourself in the home and mortgage. To find great mortgage rates, start by using Credible’s secured website, which can show you current mortgage rates from multiple lenders without affecting your credit score. You can also use Credible’s mortgage calculator to estimate your monthly mortgage payments. Lock in low rates currently available and save for years to come! If you secure a fixed mortgage rate your payments won't be impacted by future rate hikes. By default we show 30-year purchase rates for fixed-rate mortgages.

She researches both current and historical trends in the mortgage industry in order to give the best analysis and guidance to readers grappling with these complex financial products. If you’re interested in taking out a mortgage, Channel’s advice is to focus on what you can afford in the current market. It’s impossible to time the market but, ultimately, if you take on a mortgage with affordable payments, you can succeed in any market. We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. Increases or decreases in 10-year Treasury yields directly influence 30- and 15-year mortgage rates.

Check that it does not include any upfront fees or points that could be charged. So looking at the APR, or annual percentage rate, provides a better all-in representation of what you may pay. Remember that you may be able to obtain a lower rate but by paying a higher percent of points.

No comments:

Post a Comment